LIME is model agnostic but not always robust, and Kernel SHAP is computationally expensive. For example, Tree SHAP is only applicable to tree-based models, and Integrated Gradients are specific to deep learning models. There are multiple explainability techniques for individual inference to choose from, each with their pros and cons. SHAP (SHapley Additive exPlanations), based on the concept of a Shapley value from the field of cooperative game theory, works well for such a scenario. For the purposes we described, Zopa needed to explain the contribution of each input feature into an individual model score. However, these methods can only provide summary insights about the model for a specific population. The data scientists at Zopa often used several traditional feature importance methods to understand the impact of the input features in non-linear ML models, such as the Partial Dependence Plots and Permutation Feature Importance. Instead of a constant proportional effect, an input feature can have different levels of impact on each model prediction. The advanced ML algorithms used in Zopa’s fraud detector can learn the non-linear relationship and interactions between the input features. They can also be more focused in their investigations and reduce friction in the customer experience.

#Aws sagemaker clarify manual#

To combat this, Zopa uses advanced ML models to flag suspicious applications for human review, while leaving the majority of genuine applications to be approved by the highly automated system.Īlthough a primary objective of such models is to achieve great classification performance, another important concern at Zopa is the explainability of these models, for the following reasons: Due to the nature of its products, Zopa is also a target for identity fraudsters. Business contextĮvery day, Zopa receives thousands of loan applications and lends out millions of pounds to their borrowers.

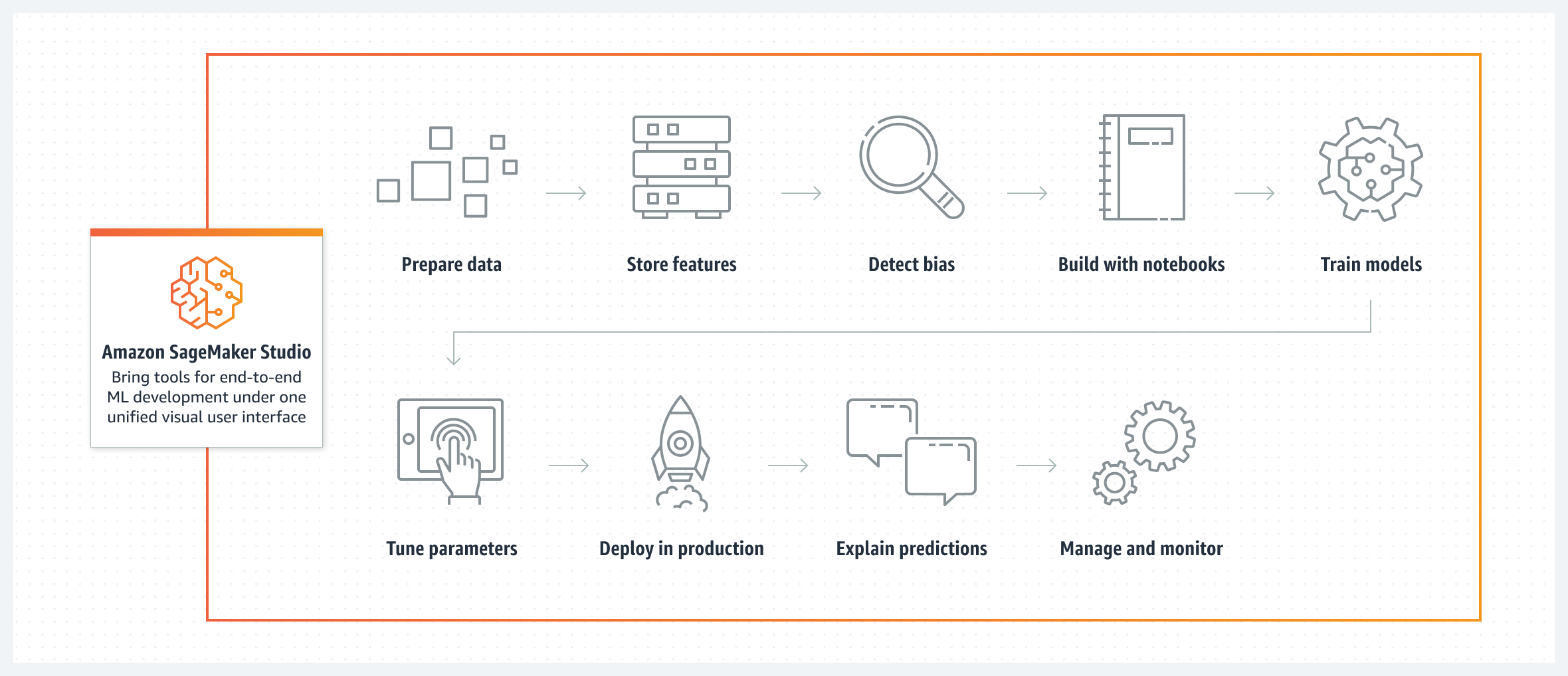

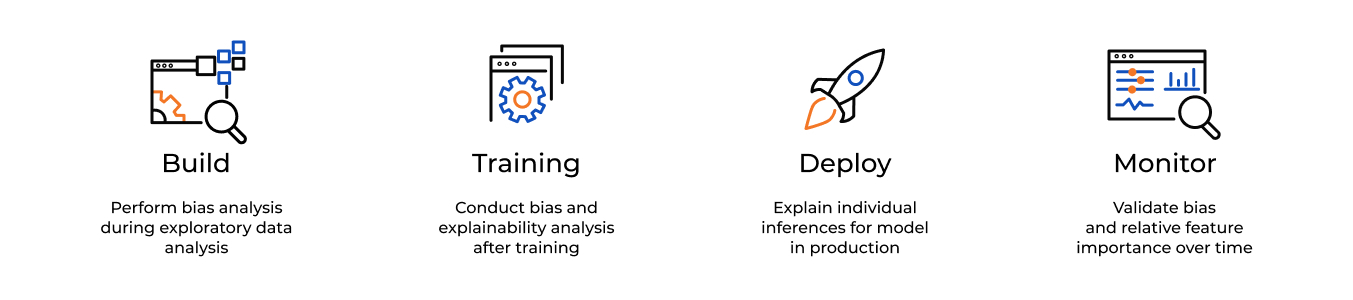

In this post, we use Zopa’s fraud detection system for loans to showcase how Amazon SageMaker Clarify can explain your ML models and improve your operational efficiency.

Technology and machine learning (ML) are at the core of their business, with applications ranging from credit risk modeling to fraud detection and customer service. Zopa’s key business objectives are to identify quality borrowers, offer competitive credit products to them, and provide great customer experience. Since 2005, it has lent out over £5 billion to almost half a million borrowers and generated over £250 million in interest for investors on the platform.

#Aws sagemaker clarify full#

In 2020, Zopa received a full bank license to offer people more ways to feel good about money. In 2005, Zopa launched the first ever P2P lending company to give people access to simpler, better-value loans and investments. Zopa is a UK-based digital bank and peer to peer (P2P) lender. This post is co-authored by Jiahang Zhong, Head of Data Science at Zopa.

0 kommentar(er)

0 kommentar(er)